BNP Paribas

-

Nederlandse Waterschapsbank was over three times covered for a 10 year affordable housing bond on Wednesday, allowing it to tighten multiple times during pricing to leave no concession, according to on-looking bankers. Meanwhile, the State of North Rhine-Westphalia has appointed banks to arrange a roadshow in Europe and Asia for a long dated euro sustainability bond.

-

Siberian Coal Energy Co (Suek) is set to tap the market to refinance an existing pre-export credit facility, according to bankers. The borrower is usually one of the first Russian names in the market, and is notable for its robust liquidity position.

-

Goldman Sachs and BNP Paribas priced a deal for auto parts maker Parts Europe, formerly Autodis, on Thursday, funding the issuer’s November purchase of Oscaro.

-

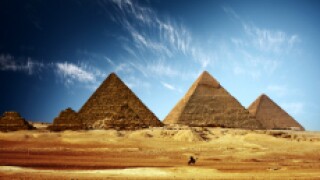

Egypt is revamping its capital markets presence, lining up a debut in the green bond market, a first deal in an Asian currency, and dollar and euro benchmarks all by the end of its fiscal year in June.

-

Turkey hit screens for a quick trip to the euro market to sell its second bond of the year on Thursday, and managed to slice 25bp from its yield.

-

-

Southern Water launched a tender offer on Wednesday as the last step in a full-scale revamp of its capital structure — a journey which helped RBS handle nearly £1.3bn in uncollateralised swap exposure — in the largest ever repackaging of inflation risk. Ross Lancaster and Owen Sanderson report.

-

The socially responsible investment market in SSAs is picking up pace in 2019, with a supranational bringing a deal in a debut format and other issuers preparing inaugural trades.

-

French hotel company Accor launched new hybrid and senior bond issues on Thursday after announcing the deals at the end of last week. The new deals finance tender offers for some of the company’s existing hybrid and senior notes.

-

IBM returned to the euro corporate bond market for the first time since 2017 on Thursday, to sell its largest ever deal in the euro market and to push into a maturity not seen from a corporate issuer so far in 2019.

-

The Republic of Turkey has returned for a bond in euros after the $2bn note it sold earlier this month rocketed in value.

-

Spain came to market on Tuesday, printing its traditional January 10 year euro benchmark and receiving an overwhelming level of demand.