Barclays

-

NRW.Bank made a big noise in a quiet dollar market this week as it printed the joint largest floating rate note from a European supranational or agency this year. Other issuers might be encouraged to follow with similar deals next week, said bankers, although a US Federal Reserve meeting on June 14 — where a target rate rise is widely expected — will bisect the window.

-

Fresenius Medical Care (FMC) — the dialysis specialist 30% owned by healthcare group Fresenius — is looking to refinance loan facilities, a month after Moody’s upgraded the firm to investment grade

-

The rise of Barclays and HSBC in UK investment banking, against a backdrop of falling fees and political uncertainty, puts further pressure on an already crowded market and the squeeze will only get worse, argues David Rothnie.

-

NRW.Bank doubled its initial size target with a two year floating rate note on Thursday, with the strength of demand partly due to investors looking for floating rate paper ahead of an expected target rate rise by the US Federal Reserve next week, according to one of the leads.

-

State Bank of India, which wrapped up a $500m syndication with 21 lenders this week, is already eyeing a new borrowing of about the same size, said bankers.

-

Bayer monetised a large stake in Covestro, the plastics company it span off in 2015, on Tuesday night through a simultaneous block trade and exchangeable bond worth a total of €2bn, which were both covered in an hour by more than 100 investors each.

-

Eurozone issuers crammed into the euro market on Wednesday ahead of a European Central Bank meeting.

-

German chemicals firm Evonik is in talks with banks to refinance a €1.75bn revolving credit facility.

-

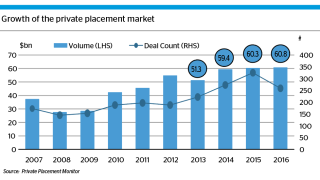

Sponsored BarclaysThe funding landscape for UK-based corporates has undergone a radical transformation since the financial crisis of 2008, driven by macro-economic changes and a growing sophistication in the way that companies finance their activities.

-

Four public sector borrowers will launch euro bonds on Wednesday, having announced deals throughout the curve ahead of this week’s European Central Bank meeting.

-

Insurance broker Towergate priced its £800m high yield bond to finance its merger with four UK peers, resulting in a new company called Kirs. The deal follows a string of successful high yield sterling issues but faced pre-election jitters.

-

European banks have already made stellar progress in working through their issuance programmes in 2017, shifting emphasis on to those with shortfalls or ‘strategic trades’ left to complete.