Banks

-

◆ Skinny new issue premium ◆ Deal 10 times covered ◆ Pricing with EU not a challenge

-

◆ French bank offers premium to investors to attain size target ◆ Deal is the tightest and longest French euro tier two in 2025 ◆ Rare Ibercaja also goes longer than the norm

-

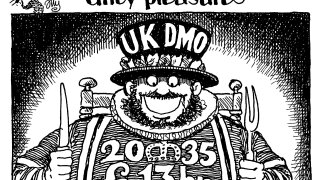

◆ Record book and deal size ◆ Investor demand 'at odds' with media headlines ◆ Key BoE actor clears up position

-

◆ Issuer initially targeted price over size but achieved both ◆ Makes sterling debuts look easy ◆ Positioning for UK membership?

-

◆ Fair value considerations point to wide range but no concession paid ◆ Earnings and market backdrop provide tailwind for tight pricing ◆ Issuer's first callable tier two in euros since 2022

-

◆ Issuers opt for 'bread and butter' 6NC5 structure ◆ Debate whether landed inside fair value ◆ French insurers bidding for long Spanish paper

-

New deal marks the first broadly wholesale capital issuance in Swiss francs after Credit Suisse's demise, say local bankers

-

Swiss bank racks up $22bn order book as investors jump for yield

-

Deutsche Bank sparks debate on whether issuers will suffer should they not call AT1 deals amid excellent market conditions

-

◆ NRW.Bank opens euro account ◆ WIBank flat to fair value ◆ Saxony-Anhalt tightens

-

RBC, Jefferies and BNP Paribas are well placed to make gains as HSBC retrenches after Deutsche Numis shows momentum

-

◆ UK and French real money bid for long-dated paper ◆ Market is under-supplied and issuer 'could have printed more' ◆ Bank earnings boost broader confidence