Banks

-

Deal expected to be priced after multi-week marketing period

-

◆ Second 'chunky' US bank euro print in a week ◆ Deal lands close to fair value ◆ But longer, fixed rate tranche raises questions as it is spotted wider in grey market

-

◆ First senior preferred in two years ◆ 3bp of concession ◆ Senior spreads 'really tight' versus covered bonds

-

Owners of the bonds face a long route to a payout but have a precedent in sight

-

◆ Sterling covered market on a 'hot streak' ◆ Strong demand pledged, including international interest ◆ Offshore sterling covered spreads compress

-

-

Credit spreads widen on private credit concerns though technicals remain favourable

-

◆ Holders win write-down ruling but path to recovery uncertain ◆ StrideUp brings Islamic innovation to UK securitization ◆ Emerging market bonds have an off-week (almost)

-

Bank lifts BNP Paribas syndicate veteran for new post

-

-

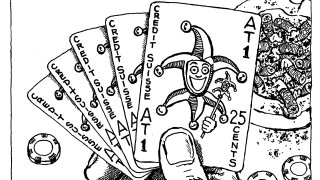

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing

-

Claims on Credit Suisse AT1 bonds shot up after a court ruling this week, though a long judicial process is anticipated