Australia

-

◆ Deal first in sterling from Australia since late 2024 ◆ Trade prices flat to euros ◆ October redemptions could drive further supply

-

◆ No premium needed for 'well-funded' name ◆ Final book the biggest in four weeks ◆ Deal attracts strong asset manager bid

-

◆ QNB deal to pique Gulf interest in euro issuance ◆ Denmark develops green market with EuGB ◆ Foreign AT1s return to Aussie market

-

Deal opens door for more foreign FIG regulatory capital raising Down Under

-

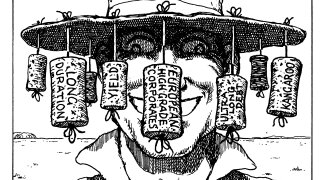

◆ Why investors are piling into SSA bonds despite the tight spreads ◆ AT1 issuers spy chance ◆ EDF pioneers in Kangaroo market

-

Industries familiar to Australian investors could find strong demand in Aussie dollar market

-

EDF proved that demand for ultra-long debt exists in Australian dollars but it won't last forever

-

◆ Popular trade performs in secondary ◆ Performance erases premium ◆ NAB offers an attractive relative value proposition

-

Company looking to become a frequent face Down Under

-

Aussie covered supply could rise if proposal to lift cover pool cap passes

-

◆ Scotia and Bank of Queensland tap the short end ◆ Single digit premium for Scotia ◆ BoQ offers spread to Aussie major peers

-

◆ Philip Morris flattens short end curve by 7bp ◆ EssilorLuxottica lands with single digit concession ◆ Wesfarmers increases deal size