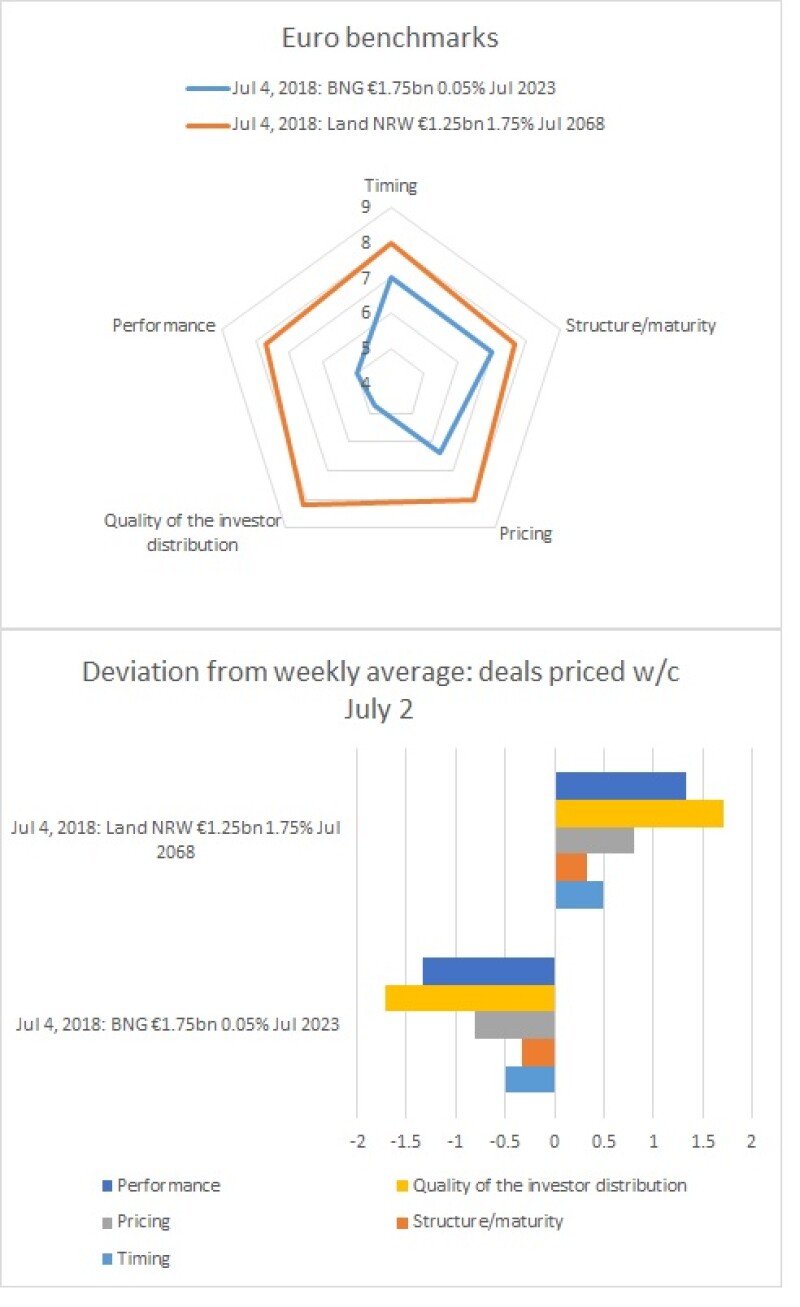

Land NRW printed a €1.25bn July 2068 on July 4, its first ever visit to the 50 year part of the curve. The bond received an average score of 7.90, but despite its novelty in terms of tenor it was in the quality of investor distribution category that the bond performed most strongly — winning an average 8.17. For structure/maturity, it received 7.67.

Bank Nederlandse Gemeenten €1.75bn July 2023, priced on the same day, was the only other trade scored on BondMarker in the week beginning July 2, but fell short of Land NRW’s deal.

BondMarker voters gave it an average score of 6.03. While timing and structure/maturity both scored 7.00, the bond suffered from a low rating for investor distribution quality — of 4.75 — and performance, of 5.00.

All of last week’s benchmarks — euro deals from EFSF, dollar trades by EIB, JBIC and NIB, and a sterling index-linker by the UK — are available to score on BondMarker until Thursday evening.