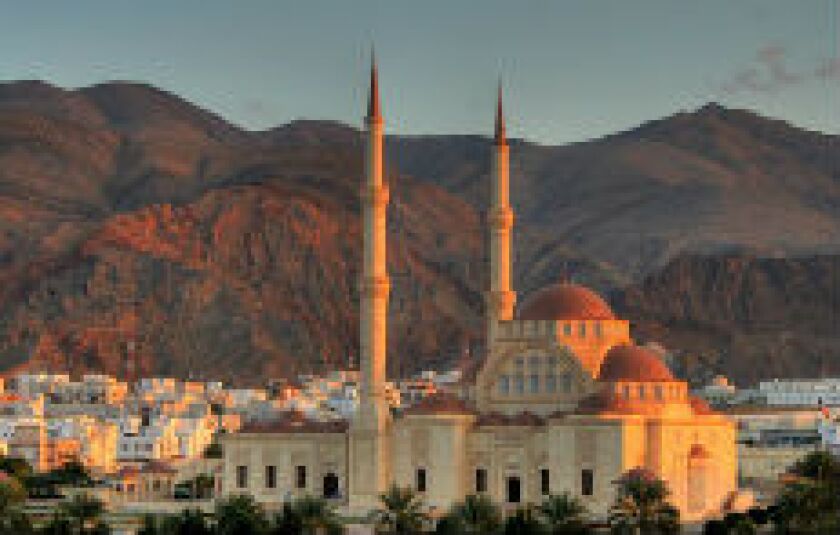

Bank Sohar’s $300m loan to be oversubscribed

Bank Sohar, the Omani bank, is expected to sign an oversubscribed three year loan for $300m by the end of February. Demand for the facility has been high from international banks despite the country’s rising budget deficit.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts