Africa

-

Loan bankers have been waiting on tenterhooks for Kenya to reveal a mandate for deals totalling as much as $1bn, with the country’s government having originally been set to make the announcement this week.

-

Turkish bank, Albaraka Turk is hoping to update its old-style tier two sukuk debt to make it eligible as capital under Basel III and has asked investors to approve the inclusion of a point of non-viability (PONV) clause.

-

Syndication of the acquisition financing loans for Lonza and Sibanye Gold is expected to begin soon, as loans bankers begin 2017 in an optimistic mood.

-

Egyptian investment bank EFG Hermes is expanding its frontier markets division, and has appointed a new CEO who joins from Exotix Africa LLP.

-

The global rise in dollar funding, combined with political upheaval and the heavy depreciation of the lira are destroying some of the historically borrower-friendly terms available in the Turkish loan market. Elly Whittaker reports.

-

While some cash-strapped borrowers in Africa will bite the bullet and pay up to access international bond markets in 2017, others will have to return to the loan market for support. Virginia Furness and Elly Whittaker report.

-

Shares in Life Healthcare, one of South Africa’s leading private hospital operators, rose 1.5% on Tuesday after it said it would raise R10.7bn ($756m) in a rights issue to reduce its leverage after buying Alliance Medical Group, the UK provider of diagnostic imaging services.

-

In this weekly round-up, the US Federal Reserve interest rate hike is pushing the RMB even lower against the dollar, a fresh batch of free trade zones could be approved for an early 2017 launch, and Tunisia’s central bank is looking at a Panda bond deal. Plus, a recap of our coverage.

-

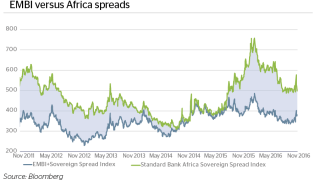

Emerging markets bonds sold off after the US Federal Reserve indicated a more hawkish tone on Wednesday — but much like what happened after the Brexit result, spreads came off their wides quite quickly.

-

Nigeria’s sovereign bond prices have rallied with a new Eurobond expected in January despite the government reporting on Monday N2.2tr ($7bn) of unrecorded debt, equivalent to 2.3% of the country’s GDP.

-

South African gold miner Sibanye has agreed to buy US palladium miner Stillwater for $2.2bn and will raise a $2.7bn loan to pay for the acquisition. Sibanye joins South African borrowers Steinhoff and Aspen in raising large loans for M&A this year.

-

Tanzania has announced plans to issue a Eurobond in 2017/18 and will be hoping to put paid to the past with the new issue after its debut bond, a private placement, hit the headlines for all the wrong reasons last year.