Weekly Covers

-

◆ Land NRW and British Columbia eye euros ◆ Rentenbank going for dollars ◆ Too soon to pre-fund?

-

-

Deal opens door for more foreign FIG regulatory capital raising Down Under

-

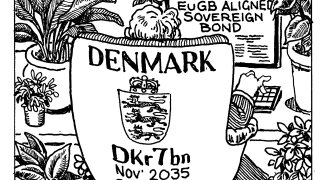

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

Less illustrious issuers may struggle to repeat Qatar bank's outcome, and more expensive euro funding would crimp interest

-

◆ Insurer sells first RT1 before calling legacy tier one ◆ Priced close to or through fair value ◆ Investors bullish on Italy

-

Mid-cap equity-linked issuance to grow

-

Sustainability-linked loan bond increased and gets better pricing than normal in kronor

-

◆ Dutch bank takes €1.5bn at four years ◆ Little resistance to pricing through 20bp ◆ Sticky book allows for tight final level

-

◆ Second SP deal from SEB this year... ◆... becomes longest point on its euro curve ◆ Some concession left as 'the right compromise'

-

◆ 'Great result' for Dutch agency ◆ Capped size, social label helpful ◆ CDPQ brought 'very interesting' deal the day before

-

◆ Royal Mail owner sells four and seven year notes ◆ Longer leg attracts the bulk of demand ◆ Bureau Veritas cuts spread by 32bp for €700m eight year