UBS

-

Buyers grapple with falling interest rates

-

A slowdown in supply is expected amid 'trickier' backdrop

-

There should be a busy start to the new year, but falling rates and widening spreads might spoil the party

-

GlobalCapital is proud to introduce the Southies, the premier alternative investment banking awards for 2023

-

◆ What the most senior debt bankers in the world believe about next year ◆ Who's eating Credit Suisse ◆ If a property company falls in the forest and doesn't make a sound...

-

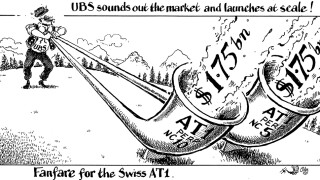

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

When the shockwave set off by the failure of Silicon Valley Bank swept the legs from under Credit Suisse, all the talent and relationships of a big investment bank were up for grabs. UBS has tried to hang on to what it sees as the best bits — but the biggest beneficiaries are likely to be rivals. Jon Hay and David Rothnie report

-

Regular Swiss issuer reopens two covered bonds in last sale of 2023

-

UBS announced on Monday that it would redeem $2.5bn AT1 at first possible date

-

City of Zurich and PSP Swiss Property take advantage of diminishing supply to appeal to investors with cash still to spend

-

Bonds will be settled in wholesale CBDC on December 1 as part of Swiss National Bank’s tokenised asset pilot

-

The Italian Ministry of Economy and Finance has cashed in on a dramatic rebound in MPS since its recapitalisation a year ago