Top Section/Ad

Top Section/Ad

Most recent

Sustainable finance chief leaves Nomura for opportunity in fast-growing region enthusiastic to cut emissions

Integrating banking and securities units intended to support growth

Hire in line with firm’s commitment to sustainability

More articles/Ad

More articles/Ad

More articles

-

Companies usually park their reserves of cash in staid, low-yielding liquid assets. But asset managers are trying to persuade them to invest some of that money differently, in a way that could help them live up to their environmental commitments.

-

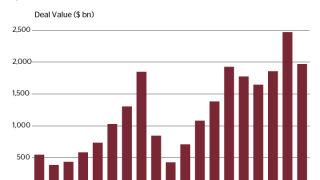

The leveraged finance market has been the best business for capital markets banks this year — but rising debt levels, weakened investor protections and the rapidly growing volumes have brought regulatory attention. Some banks are pulling back from the most aggressive deals, but others are taking their place, and a burgeoning non-bank lending sector is keeping the market white hot regardless.

-

Credit Suisse used part of an investor day on Wednesday to offer a staunch defence of its leveraged finance business, which forms a larger part of its investment banking and markets business than at its major competitors, but which has seen increasing regulatory scrutiny this year.

-

BNP Paribas managing director Ravina Advani has been appointed head of energy, natural resources and renewables in the firm's coverage division.

-

The European Union has taken a step towards using the bank capital risk weighting system to favour green assets and discourage ‘brown’ unsustainable lending — one of the most controversial issues on the sustainable finance policy agenda.

-

Wells Fargo's head of credit origination for the EMEA region has joined Intesa Sanpaolo’s loan syndicate desk.