Top Section/Ad

Top Section/Ad

Most recent

Marco Ferrari joins Stockholm office from Nordea

One major bank has underwritten three infra deals in the last week

Agreement includes accordion facility

Flooring company's bespoke 'super senior funding' was done away from the syndicated loan market

More articles/Ad

More articles/Ad

More articles

-

UBS has kicked off its first round of job cuts ahead of unveiling the new leadership of its corporate finance business

-

UK pub company was one of many to agree coronavirus pandemic waiver on debt testing

-

The deal was the first to be completed since Global ABS

-

CLO managers hold majority of the French grocer’s €1.4bn term loan B

-

-

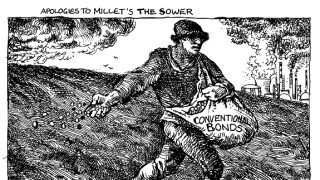

Ineos Enterprises relaunches TLB after pulling it post-Credit Suisse, but only for refinancing