Sterling

-

◆ UK ports operator extends sterling run ◆ Orderbook remains sticky despite tighter spread ◆ Negative new issue premium

-

◆ Orders swell despite lack of new issue premium ◆ 'Severe shortage' of deals ◆ Nationwide 'optimises' its tier two capital

-

◆ Several factors led to choosing sterling maturity ◆ New UK investors arrived in recent deal ◆ Patience when evaluating cross-currency basis and spreads

-

Green loans and project financing needed for Europe-wide rollout

-

Diversifying demand... coming inside euros... landing flat to dollars... the UK market looks tasty

-

FIG supply clustered at the front end with a flurry of floaters

-

◆ Deal first in sterling from Australia since late 2024 ◆ Trade prices flat to euros ◆ October redemptions could drive further supply

-

◆ Canadian bank returns to senior sterling market 13 years after first attempt ◆ Similar strategy taken as in euro, Australian dollar and Swiss franc markets ◆ Treasurer eyes subordinated issuance in future

-

◆ Cross-currency basis was a factor for issuer ◆ Big orders build as new investors emerge ◆ Other dollar funders eye sterling opportunities

-

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

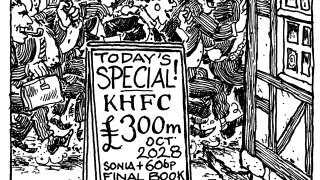

◆ Price sensitivity returns as deal premium shrinks ◆ Final book dropped by more than half ◆ Deal did not go as well as TfL's sterling trade, say bankers

-

Guidance slashed but still a rare chance to earn 10% in primary market