Top Section/Ad

Top Section/Ad

Most recent

A selection of the clever, funny and weird to keep your mind sharp over the new year break

European and high yield chiefs to take the reins

More articles/Ad

More articles/Ad

More articles

-

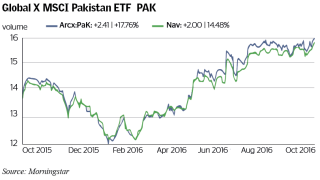

Pakistan’s capital markets are back in business after a few lean years, with M&A deal volume and the Karachi Stock Exchange at record highs, and investors chasing yield in a country now promoted to MSCI ‘emerging market’ status. Rules passing through parliament are expected to underline the country’s reputation as a great place to do business

-

French agency Unédic is looking to set a trend with its new medium term note format to replace its BMTN programme as the chosen vehicle for one to six year debt

-

The Green Climate Fund, set up by the United Nations as a channel for money to help developing countries fight and cope with climate change, has chosen a new executive director.

-

The UK Debt Management Office will transfer its responsibility to provide reference prices on the £1.4tr Gilts market to FTSE Russell and Tradeweb, likely by the spring of next year.

-

The Republic of Namibia, which has outlined plans to issue around $5bn of loans and bonds over the next 10 years, is to undertake a non-deal roadshow with fixed income investors in the US and UK.

-

Kemi Adeosun, the finance minister of Nigeria, has attacked the “hypocrisy” of Western governments in stopping developing countries accessing development bank finance for coal power.