Top Section/Ad

Top Section/Ad

Most recent

A selection of the clever, funny and weird to keep your mind sharp over the new year break

European and high yield chiefs to take the reins

More articles/Ad

More articles/Ad

More articles

-

2019 is likely to be another year where the independent mandate of central bankers comes under pressure from populist politicians in democracies. It is easy for those in the market to sympathise with the quiet technocrats over the loud-mouthed headbangers, but scrutiny is deserved.

-

European Union member states are set to soothe banks’ concerns about having too tight a window to change their risk-free euro reference rate from Eonia, with a postponement of the transition to Ester due on Wednesday.

-

Italian populists rocked Europe in 2018, bringing fresh political and market turmoil, highlighting the EU’s failures while simultaneously making it harder to solve them. When the next crisis arrives, the bloc may well rue missed opportunities to shore up the financial system.

-

Participants at a Transparency Task Force symposium on Monday told representatives of three UK financial regulators they welcomed their efforts to step up oversight of the financial system’s response to climate change — but they called for regulators to be more ambitious, as scientists say the world has 12 years left to get global warming under control.

-

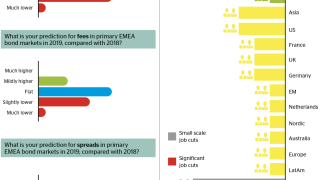

Pain from Brexit, higher interest rates, quantitative easing ending and political strains in the EU will all lead to more volatility in 2019, according to 22 heads of debt capital markets in the EMEA market, including 18 of the top 20, in Toby Fildes’ annual outlook survey. And that’s before Donald Trump, Vladimir Putin and Mohammed bin Salman get going. There is some good news, however: financial institutions are set to be big issuers, and the DCM heads expect to be net hirers...

-

Financial markets are often seen as cold, calculating machines for making money. That is part of their function. But increasingly, people are talking of markets’ broader social purpose — that they exist to serve humanity and make its existence healthier and more sustainable. Toby Fildes argues that, 10 years on from the crisis, this new ethos will govern the markets’ future.