Santander

-

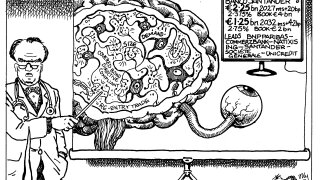

Larger banks’ senior bonds are in demand though smaller FIG issuers fill pipeline

-

Gonzalo Álvarez-Cañedo will relocate to New York to take top job

-

US inflation print sends Telia’s hybrid deep into red

-

Short dated, highly rated issuance manages to push through fair value

-

Pair of issuers get ahead of upcoming large EU syndication

-

Volatility drove foreign bank issuers into the arms of the world’s most liquid capital market

-

Big books on offer as investors take pick of ESG, debuts and sterling

-

RBC, ING Diba, BSH and Danske pre-fund in size in case market conditions deteriorate

-

High grade corporate greeniums are holding on but demand outstrips supply

-

The UK bank’s COO of international and IB joins as the Spanish outfit looks to grow its global offering

-

The two-part deal was a ‘no-brainer’ due to its generous pick-up and high yield

-

Nine and 10 year maturities come after BT faced tough time with its own 10 year trade