Nordics

-

Scandinavian Tobacco, the cigar and pipe tobacco maker, rose 2% when it made its stock market debut on Wednesday, before returning to the level at which its IPO was priced.

-

Sanoma, the Finland headquartered media and publishing company, has retained support from its relationship banks in a €500m refinancing deal. But two banks did not return, as the group sought to slim down its syndicate.

-

Swedbank and SEB this week launched deals that attracted the largest order books and the widest distribution of any covered bonds issued this year, along with the smallest concessions.

-

Kommunalbanken on Wednesday sold the first five year dollar benchmark from an SSA in three weeks, printing a $1bn no-grow bond.

-

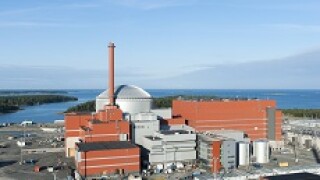

Teollisuuden Voima Oyj (TVO), the Finnish nuclear power company, has refinanced its €1.3bn debt facility with a reduced syndicate.

-

Stockholm County Council has selected four banks for a green bond roadshow, beginning on February 8, with a view to selling a euro green bond.

-

Swedbank was set to issue a €1.25bn five year covered bond on Wednesday. The deal attracted more investors than any other covered bond this year, and a larger volume of orders. The new issue concession was small, but the deal’s success was driven by a yield nearly 0.5% more than OBLs

-

Cigar and pipe tobacco manufacturer Scandinavian Tobacco has received enough demand from investors to get its Copenhagen IPO done, but it is not yet covered throughout the price range.

-

Danske Bank launched its largest ever share buyback on Tuesday, having exceeded its regulatory capital requirements by more than expected.

-

Commonwealth Bank of Australia (CBA) funded itself more cheaply with a 15 year covered bond than it did with a five year this week. It followed Swedish Covered Bond Corporation (SCBC) which issued at the same spread as earlier deals despite a market widening.

-

Cigar and pipe tobacco manufacturer Scandinavian Tobacco has set the price range for its all-secondary IPO at a “very considerable discount” to comparables, according to a banker on the deal.

-

Two covered bond issuers from Sweden and Germany launched euro benchmarks on Tuesday. Both transactions were healthily oversubscribed, but with a wider starting spread, Swedish Covered Bond Corporation (SCBC) was able to issue a much larger volume, and tighten pricing during the bookbuild.