Nordea Markets

-

Banks that deal in Yankees, including Nordea, HSBC and BPCE, raised $16bn in new funding as the market reopened with a bang after the Labor Day holiday.

-

The Nordic high yield market has started to price several top rated euro deals that were initially planned to roadshow before the summer break. This time, demand and coupons suggest this could be a better window for the issuers.

-

ABN Amro took advantage of a stable background and quiet market conditions to re-open the Yankee bank market this week, with a $2bn trade that attracted more than $7bn in orders.

-

Russia’s Mechel has signed a $1bn-equivalent loan facility, as the metals and mining group pushes ahead with plans to restructure its debt portfolio by the end of 2018.

-

Sweden’s Modern Times Group (MTG) and its subsidiary Nordic Entertainment Group have agreed a five year revolving credit facility in the run up to the subordinate company being spun off.

-

The European Securities and Markets Authority recently fined a clutch of Nordic banks for breaking credit rating regulations. The decision could have implications for the Schuldschein market — where arranging banks issue similar ratings to investors.

-

The European Securities and Markets Authority’s (ESMA) decision to fine five Nordic banks last week has raised two questions: just how consistently will rules be applied across Europe, and is it even appropriate that they are?

-

Ferd Invest sold a stake in Petroleum Geo-Services, the Norwegian company that provides surface imaging to oil and gas exploration companies, on Monday night after the stock rallied due to higher oil prices over the past 12 months.

-

The European Securities and Markets Authority on Monday issued fines to five banks from the Nordic region totalling €2.475m, for issuing credit ratings without having gained the necessary approval.

-

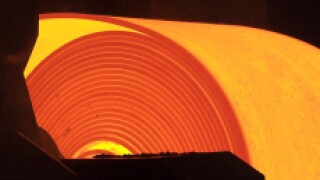

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

DLR Kredit has become the first bank to convert senior debt that has been contractually subordinated into bonds that are subordinated by law, cementing the insolvency status of its creditors and paving the way for other firms to follow suit.

-

Nordea followed the path Danske Bank took a few weeks ago by turning to Swedish kronor for senior non-preferred debt on Tuesday, soon after its inaugural euro transaction in the instrument.