News content

-

Norwegian oil exploration company Det Norske has completed syndication of its $550m revolving credit facility and also increased its reserve base lending facility.

-

Dutch conveyor belt provider Ammeraal Beltech has bucked the sour mood infecting leveraged finance markets, closing a €300m loan that backs its buyout by Advent International.

-

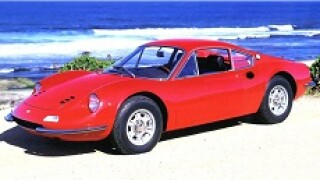

Fiat Chrysler Automobiles has completed syndication of a €5bn revolving credit facility, in the company's first loan refinancing since Fiat Group Automobiles merged with Chrysler last year.

-

BPCE priced its second Samurai deal of the year on Wednesday. The Japanese market is proving a useful source of funding as the Greek crisis forces issuers to avoid the euro and dollar markets.

-

Icelandic lender Arion Bank has printed its second international bond of the year in, this time opting for Norwegian kroner, which enabled it to save 100bp after swapping back to euros.

-

Industrial development bank Turkiye Sinai Kalkinma Bankasi has mandated Commerzbank to arrange a one year loan that, like its Turkish peers, could contain a novel 367 day tranche.

-

Only three days into the week, one can safely say this is the most trying one for Europe’s equity capital markets so far this year. But even as the count of cancelled IPOs mounts, some deals are still squeaking through.

-

SSA bankers hoped on Wednesday morning an agreement on Greece’s economic reforms could be reached to unlock the public sector pipeline after the country fell into arrears with the IMF on Tuesday night with bailout requests and a referendum keeping primary market activity subdued.

-

After panic on Monday, a sense of order returned to the FIG market and while things are certainly much weaker and flows very light, traders are marking bonds tighter once more.

-

Arab Petroleum Investments Corp (Apicorp) is likely to bring its debut sukuk deal in September, and has ambitious price plans for the first issue of its newly rated sukuk platform, according to debt bankers.

-

Flow Traders Coöperatief, the Dutch financial trading firm, put out a price range for its IPO on Tuesday morning and opened the books.

-

Eusktaltel, the Basque Country telecoms firm, priced its Madrid IPO on Monday in the lower half of the range, raising €764m, in a volatile week for stock markets as the Greek crisis rolls on.