News content

-

Swire Properties received a good reception for its $500m bond on January 6, capturing an order book that was more than three times bigger thanks to its safe haven status in a volatile market.

-

The Islamic Republic of Pakistan has increased the size of its latest loan to $325m from $300m after a few more lenders joined the deal at a later stage.

-

Latin American development bank CAF (Corporación Andina de Fomento) sold its first ever bond marketed as an SRI deal on Tuesday with a “Water Bond” issued in Uridashi format and denominated in Turkish Lira and South African Rand.

-

Wednesday brought red back to equity traders' screens after a buoyant Tuesday, but trading action confirmed the satisfactory execution of this year’s first two substantial equity capital markets deals in Europe: the €1.03bn block trade in NN Group, the Dutch insurer, and French aerospace firm Safran’s €650m convertible.

-

Serendex Pharmaceuticals, the Danish healthcare company, has completed its Nkr111.8m ($12.5m) rights issue, having achieved full subscription.

-

2015 set a number of records in the options market as traders flocked to index and volatility-linked products, but equity options volumes dipped due to factors that look likely to persist in 2016.

-

Get bought or go bust: Is this the year when vulnerable oil & gas companies have to make the choice? So far this year, derivatives traders are pricing contracts for more vulnerability to come.

-

ISDA’s Determinations Committee has decided to hold a second day of discussions on Novo Banco, after failing to reach agreement on Wednesday over whether the Portuguese bank has triggered a government intervention credit event or a succession event.

-

While the last few years have been all about the European high yield bond market rapidly developing into a dependable financing source for private equity sponsors, 2015 saw the loan market fight back. But as Max Bower and Victor Jimenez point out, it has done so at a time when LBO sponsors face increasing competition from IPOs and trade buyers.

-

Middle Eastern loans burst open in the fourth quarter of 2015, with deals aplenty for corporates, banks and sovereigns. The deal flow will not ebb this year, but pricing will rise and international lenders will play a bigger role, replacing local lenders. Elly Whittaker reports.

-

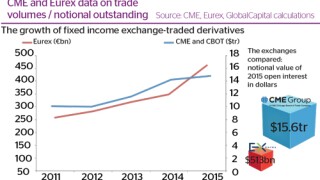

Competition between derivatives exchanges is intensifying, giving rise to a rash of product and platform launches in 2015, as well as geographical expansion. But 2016 will be dominated by regulatory deadlines for electronic trading. As Dan Alderson reports, exchanges that best prepare market participants to meet these requirements will be the ones that will win out.

-

2015 will be remembered as a year when volatility returned to financial markets. With strong technical buffers to the trading range of US and European equity markets going into 2016, short volatility strategies look set to be compelling money earners in the year ahead, writes Andrew Barber.