Lloyds Bank

-

◆ Record size, record book and record investor offers ◆ UK financial year syndication target 80% complete ◆ Demand diversity ‘very notable’

-

◆ DMO completes hefty chunk of syndication target ◆ Record size, record book ◆ Demand for 15 year 'encompasses a broad range of investors'

-

Wide breadth of choices is enabling investors to be picky

-

Bankers split on expectations as ‘everyone has been in the market’

-

UK bank's second foray into the subordinated Aussie bond market

-

◆ Report examined if eight major UK banks could enter resolution safely ◆ One bank singled out for a ‘shortcoming’ ◆ ‘Areas for enhancements’ identified in five

-

Central bank rate cuts could unlock asset rotation into riskier parts of the capital structure

-

◆ Lender raises €1bn of seniors a day after compatriot ◆ Pricing tight but less demand than for first mover ◆ Slim concession, if any

-

New hire will replace executive moving internally

-

Sponsored by Lloyds BankIssuers need to look to the future with clearly defined objectives and remain agile.

-

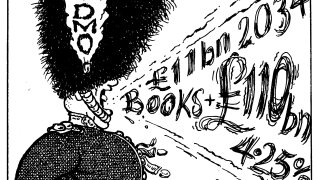

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors

-

'Textbook execution' lands sovereign issuer 'blowout deal'