Italy

-

The smaller Italian issuer was able to harness solid demand to net a 'good' 30bp price move

-

Banks keen to use 'positive momentum' while the issuance window is still open

-

Glocos relieved by 'better than anticipated' result

-

Bankers on the deal are confident about auctioning the remaining rights

-

Italy surprised with economic expansion last quarter but the spread between BTPs and Bunds widened after it was said that the government will take on additional borrowing in 2023 to fight the energy crisis

-

New funding entities could help Italy but benefit will be magnified with tighter spreads

-

Italian sport and culture funder occupies grey area between SSA and FIG

-

Italian holding company manages to get some spread movement after Monday’s deals stalled

-

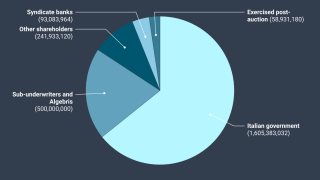

The €2.5bn dilutive rights issue accompanies a four year strategic plan

-

But analysts suggest latest Pepp holidngs may not reflect up to the minute ECB buying

-

Investment grade market keeps churning out deals

-

• The way out of UK market disarray • Italian banks in a better state • Bring back the bonus cap, say bankers