Italy

-

Both new issues were priced flat to fair value, said bankers on and off the deals

-

The Italian Ministry of Economy and Finance has cashed in on a dramatic rebound in MPS since its recapitalisation a year ago

-

Transition bonds continue to gain a foothold in ESG markets

-

◆ First euro AT1 for more than two months as Santander, other G-Sibs went for cheaper dollars ◆ Non-national champion status makes it 'not straightforward' execution ◆ Ongoing strong bid for yield

-

Car leasing firm bumps up deal size between guidance and final terms

-

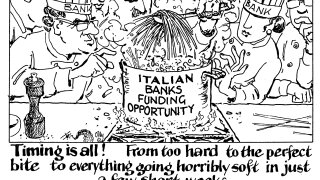

Italian banks should seize a lift in sentiment to distance themselves from the sovereign

-

BTP's overnight performance helped secure domestic interest

-

-

Lender prepares four year covered bond deal as funding conditions appear to ease for Italy and its banks

-

No Pepp talk from Lagarde relieves market participants but issuance could face ‘headwind into next year’

-

The spread was closely calibrated to ensure critical domestic demand

-

Agency issuers appeared after the EU cleared a €7bn syndication