Issues

-

Fast-growing Stifel and Cantor target Europe and Middle East

-

Issuers' desire to put covered pre-funding to one side suggests concerns over bumps ahead

-

Data-deprived markets should give the shutdown the attention it deserves

-

Sukuk may not be available to every Turkish company, but plenty could do it

-

◆ No competition from similar Contact Energy ◆ Stedin seals larger than average spread move ◆ Investors left book as price ground tighter

-

Further long-dated SSA issuance is expected to be limited given funding requirements

-

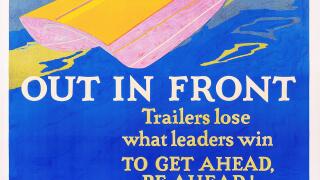

Hit by an alleged ‘fraud’ at the bankrupt US car parts maker, Wall Street’s last pure play investment bank has its sights set on European leveraged finance as it expands its alliance with SMBC

-

◆ Tightest SNP in euros since January 2022 ◆ 38% book attrition ◆ 'I'd rather be holding one of the best banks in the world'

-

◆ Alpha enjoys IG welcome ◆ Order book five times subscribed with a touch of concession ◆ South European banks' 'convergence pattern'

-

With the Fed tipped to ease again, bankers say curves could grind flatter at the front end

-

Swedish miner Viscaria completes directed share issue

-

◆ Nearly $12bn of orders for long-dated dollar deal ◆ Official money places chunky bids ◆ Bond performs, pulls peers’ spreads tighter