Issues

-

One of the largest social housing providers in the UK gets two new lenders on credit facility

-

Hire supports BNPP's growing CEEMEA bond franchise

-

Many investors are still uncomfortable with smaller airlines, said one fund manager

-

Public holidays and high profile events mean borrowers will be crammed into a few issuance days

-

◆ Short-end yield and pick-up attractive ◆ Duration bid from insurers persists ◆ Investors eye senior non-preferred over tier two amid supply divergence

-

Trade prices inside the curve of Abu Dhabi peer Mubadala

-

Privately owned Dubai supermarket group is set to begin trading next week

-

CFO and former trader is seen as natural successor after Noel Quinn unexpectedly stepped down

-

Christian Noyer has proposed that the safe savings asset that European leaders crave should be a securitization platform. But scepticism that this is a realistic project runs high

-

◆ French bank pulled its €500m capital funding in early January amid crowded market ◆ New deal offers some call premium compared to the earlier bullet note ◆ Clears with up to 5bp-10bp new issue premium

-

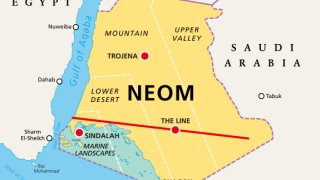

Only Saudi banks provide facility, as Western banks say the lack of ancillary opportunities makes the business case difficult

-

Borrowers at either end of ratings spectrum find success with green paper