Issues

-

Tannenbaum will be new head of EMEA corporate and investment banking

-

◆ Transdev debuts among some big trades ◆ Abertis looks to pay zero premium on hybrid ◆ Heidelberg Cement pays low concession after big rally in its debt

-

◆ Last euro syndication for 2025, done ◆ Good timing as usual ◆ Book is one of sovereign’s largest

-

◆ US companies Pfizer and McDonald’s raise euros ◆ Pfizer pays zero concession but some thought it looked cheap ◆ McDonald’s cooks up almost €4.7bn book at peak

-

◆ Joint biggest deal of the year attracts largest book since last May ◆ Final spread the tightest in almost a year ◆ Sterling offers saving compared with euros or dollars

-

-

The clean energy company has hit fair value

-

UK government’s plan to force pension funds to allocate funds to specific assets goes against the pension industry’s core duty

-

-

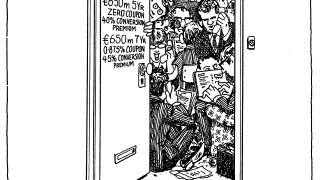

Convertible market is hot, say bankers

-

◆ Trade the tightest in euros since early April ◆ Single digit concession paid ◆ Deal comes close to SSA curves

-

◆ EU brings 'return-to-normality' trade ◆ KfW prints large new green bond ◆ Duo show leadership, more issuers to follow