Free content

-

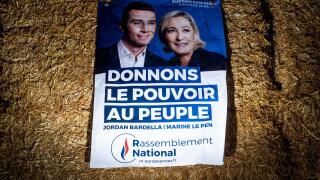

◆ UK ousts Tories from power... ◆ ... setting up final round of French elections as only bar to primary market revival ◆ EM debt restructurings: balancing what creditors demand with what voters need

-

UK bank spreads calm and Gilt yields stable but all eyes turn to less predictable French elections

-

As Deutsche Bank showed this week, the long tenor trade is still on

-

The next six months of 2024 are shaping up to be more like a three week window

-

IPO after IPO fails in Europe, though equity capital markets in general work well. Look at the flotation process: it’s no surprise it malfunctions

-

As supply becomes scarcer, it will be easier for companies to sell dirty debt as green

-

◆ Natixis’s sometimes requited love affair with elite M&A bankers ◆ What the French election could to ESG, and to the bank bond market

-

After a rough 2023 when Nordic banks were forced to issue covered bonds at shorter tenors, borrowers have relished the chance to fund further out on the curve so far this year, securing tightly priced and popular deals, writes Frank Jackman

-

Nordic banks have had a great start to 2024 in the bond market, compressing their unsecured spreads to well below where they could fund in previous years. Despite these rich levels, investors have shown no reticence when it comes to placing orders, reports Frank Jackman

-

The Nordic market has been a nursery for ESG debt innovation since the market’s inception. Now banks in the region are working on new ways to fund the green transition, writes Frank Jackman

-

The Nordic region has a long and proud history in social welfare, sustainability and related areas, so it is naturally well placed to play a prominent role in green finance too. GlobalCapital gathered a panel of prominent market participants together in June to discuss key themes and consider the next big developments

-

Iceland has implemented one of the strongest financial regulatory frameworks globally as it looks to shake off the spectre of the 2008 crisis. But are these stringent requirements too restrictive? Philip Moore investigates