Free content

-

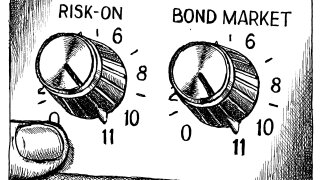

The year is not yet at its halfway point but, already in 2025, global bond markets have had to face anxiety about European and US governments wanting to spend more, including on defence, and fears about the aggressive trade policy of the new US administration. During these testing times, however, new issue data demonstrate the resilience and flexibility of the primary market, writes Addison Gong

-

To secure their countries in uncertain times, governments around the globe are set to increase defence budgets to a size that has been rarely achieved in a generation. Strained public finances suddenly present an immediate barrier to the security of the public and key players in the capital markets are rushing to act, writes Elias Wilson

-

US Treasuries have long been the foundational asset underpinning the global financial system. But recent policy proposals from the White House have shaken this foundation, and what this means for capital markets participants seems perilously uncertain, writes Elias Wilson

-

As volatility continues to plague the US Treasury market, public sector issuers have found themselves at the centre of attention of investors seeking high quality, liquid assets as an alternative investment to US Treasuries. Market participants eagerly await further evidence in the coming months of any meaningful shift in investors’ behaviour. The early signs are certainly encouraging, writes Addison Gong

-

Sponsored by AFL (Agence France Locale)Created 10 years ago by and for French local governments, AFL’s mission is to facilitate the latter’s access to funding. 2024 was a record year for the bank, which topped 1,000 members for the first time and granted loans worth €2bn during the year. Today, AFL ranks among the leading lending institutions for the French local public sector. Yves Millardet, chairman of AFL’s management board, looks back at these 10 years of growth and discusses the prospects for future development

-

◆ How can the EU capitalise on US missteps? ◆ New US insurers head to euros ◆ The greenest of green

-

Conference told role for ABF in euro energy transition, defence, infra

-

Enjoy the roaring markets while you can, they won't last long

-

The difficulty of hitting the standard makes it a standard worth having

-

Other topics: EUR35T of assets on European bank balance sheets, CLO due diligence data cut looms

-

More the 30 CLO equity buyers active, conference told

-

The ECB's hawkish rhetoric shouldn't dissuade investors from expecting further curve steepening