France

-

French, German and Dutch banks are forecasted to print a combined benchmark volume of around €75bn, with 2024 looking like another year of positive net supply

-

French agency aims to diversify currency mix via benchmarks and PPs, and execute euro taps

-

Existing shareholders each gave away part of or all of their rights, making way for new family office to wield a stake

-

Issuer to bring six syndicated benchmarks across euros, dollars and sterling in 2024

-

There is hope for next year after a disappointing year for French equity capital markets

-

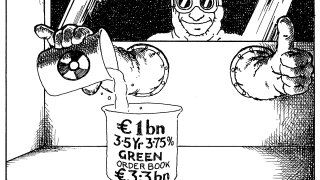

Real estate borrowers continue to find market access in winter rally

-

Bank of America was the sole bookrunner on the €70m sale of Soitec shares on Thursday night

-

-

Investment grade corporates keep piling into euros

-

Covivio and Realty Income Corp put out impressive trades

-

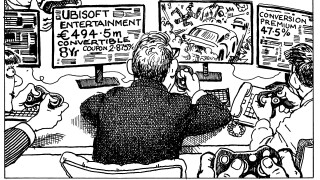

Shares in the French game publisher fell more than 8% after the convertible and delta placed

-

Retail bid to the rescue as central bank bows out