Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ Austrian lender completes its tightest unsecured debt since the start of war in Ukraine… ◆ …as BPM achieves its lowest ever senior spread ◆ High attrition function of premium and outright spread

◆ Issuer finds window between political volatility and supply onslaught ◆ Deal sets record low spread for callable sterling senior bail-in debt ◆ Investors remain on board despite tight price

◆ Deal unaffected by Japanese macro volatility, lead said ◆ Aggressive pricing led to heavy long-end attrition ◆ Continuing trend of heavy supply for dual tranche holdco senior trades

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

More articles/Ad

More articles/Ad

More articles

-

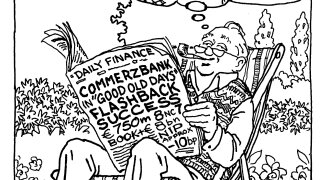

Senior market 'in good shape' with plentiful of liquidity

-

◆ Leads say deal landed well inside fair value ◆ Rivals say result points to ‘halcyon days’ of early 2024 ◆ Other issuers said to be eyeing Rabobank's callable FRN structure

-

As Bastille Day — and the start of what is often a lull in capital markets — approaches, the fate of billions of euros of FIG and corporate bonds lies at the whim of UK and France voters

-

The Australian dollar deal is the first of its kind from US insurance heavyweight since 2020

-

◆ NIP consensus among bankers ◆ BMO finds it 'easier to attract demand' ◆ Favourable ‘timing’ and ‘optics’

-

◆ More than €12bn of interest for popular offering ◆ 'All box-ticking' social leg was expected to do well from the start ◆ 11 year non-call 10 tranche shows duration demand intact