Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ Austrian lender completes its tightest unsecured debt since the start of war in Ukraine… ◆ …as BPM achieves its lowest ever senior spread ◆ High attrition function of premium and outright spread

◆ Issuer finds window between political volatility and supply onslaught ◆ Deal sets record low spread for callable sterling senior bail-in debt ◆ Investors remain on board despite tight price

◆ Deal unaffected by Japanese macro volatility, lead said ◆ Aggressive pricing led to heavy long-end attrition ◆ Continuing trend of heavy supply for dual tranche holdco senior trades

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

More articles/Ad

More articles/Ad

More articles

-

-

Bankers away from deal voiced concerns over level of orders

-

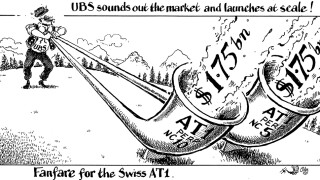

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

Rate peak joy soothes angst over Austrian collapse, but losses will surface

-

◆ Rate cut expectations raise appeal of bank debt ◆ NBC and Ally Financial push annual issuance to $593bn ◆ Yankee and US regional banks expected to lift supply in 2024

-

◆ Interest rate expectations power demand for higher yielding bonds, duration in covereds ◆ Synthetic indices tighten to fresh 12-month low ◆ Market in rude health for January issuance