Top Section/Ad

Top Section/Ad

Most recent

Originator hired to go after bank bond issues in euros and dollars

Long-standing FIG DCM banker leaves after more than two decades

Syndicate and trading executives get wider responsibilities

More articles/Ad

More articles/Ad

More articles

-

The European Council on Tuesday confirmed its position on the review of the European system of financial supervision. It maintained that supervisors should not be funded by private firms, but agreed to give the European Securities and Markets Authority (ESMA) more power. But there is now a rush to find an agreement with the European Parliament before its members go on leave for May’s elections.

-

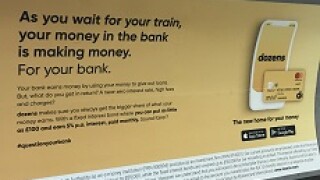

Dozens, the latest digital banking offering, aims to revolutionise retail banking in favour of the customer, by routing returns back to depositors and avoiding most unsecured consumer lending. Is this an unworkable goal, or is founder Aritra Chakravarty on to something?

-

Southern European banks were given a lift at the beginning of the week, when they emerged from the European Central Bank’s annual supervisory review and evaluation process (SREP) with their capital requirements broadly unchanged.

-

Olaf Scholz, finance minister and vice-chancellor for Germany, said that there was 'no debate' about the creation of a bad bank in a prospective merger between Deutsche Bank and Commerzbank. He also does not believe that the recapitalisation of NordLB by the association of German savings banks would contravene EU state aid rules.

-

Rating agencies and investors are realising they have more in common than they thought when it comes to environmental, social and governance (ESG) factors. And they are more inclined now to work together than find fault.

-

BNP Paribas and Société Générale both announced new plans to slim down their investment banks this week. They posted sharp drops in revenue across global markets operations that were, on balance, a bit worse than those registered so far by the rest of the industry.