Europe

-

UK and South Africa firms to collaborate on equity research, trading and advisory

-

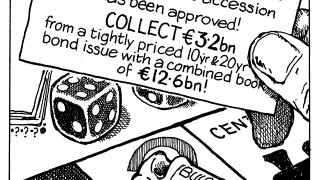

No sign of an issuance drought in hot market

-

◆ Deal eight times subscribed ◆ Spread cut to mid swaps plus 120bp ◆ Investors flush with cash amid scant supply

-

German company has been actively acquiring and divesting real estate since late 2024

-

◆ €500m bond six times subscribed ◆ Only 1bp off NRW's recent five year ◆ Tenor, yield, timing all attractive

-

◆ Greek bank's first bond of the year vastly improves on last year's financing ◆ Scarcity appeal, buyback, and higher UniCredit ownership help crunch spread ◆ Old bond to be bought back above par

-

Swiss real estate firm's stock has risen 65% this year

-

◆ Deal slotted into a quiet calendar ◆ Liquidity abundant after Terna’s blockbuster EuGB ◆ Fair value seen at mid-swaps plus 117bp

-

The sovereign also issued one of the longest date deals from a CEEMEA sovereign this year

-

Company's bespoke financing will help fund growth

-

The UK will do better with tactical retreats on regulation than risking being outflanked by the US's wildcat banking regime

-

◆ Mediobanca latest Italian bank to fund amid M&A ◆ Deal well absorbed even at negative NIP, though some debate on price ◆ Similar dynamics gave Ifis tight spread and concession