Euro

-

◆ Deal attracts more than €10bn ◆ Rarity of name and jurisdiction fuels demand ◆ No premium needed to take size

-

◆ Toyota and Logicor drum up strong books in euros ◆ Volkswagen proves sterling investors still looking to allocate funds ◆ Liquidity trumps all

-

Part of a 'wave' of large ESG deals, according to a lead banker

-

Bank goes further than Crédit Ag and SocGen in avoiding regulatory call

-

Increased residential lending demand could help support issuance

-

Issuance window is open and conditions are great but issuers stand pat

-

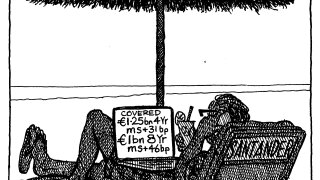

With conditions this good, it makes sense for companies to take a dip

-

◆ First euro green bond for the issuer ◆ Spread to peers 'quite an achievement' ◆ Solid order book throughout

-

Larger deals expected to hit market 'anytime'

-

◆ Swiss bank issuance is novel for the euro FIG market ◆ Mixes elements of senior and covered FIG debt, and SSA bonds ◆ State-backed deal performs well

-

Now 75% funded for this year, the agency is planning another benchmark for after the summer

-

Some borrowers are taking a break but others are taking it seriously