The summer slowdown is a well established spell in the corporate bond issuance calendar. But this year the arguments to keep on printing are stronger than ever.

Late July through to late August is a time when many people in the bond market are, the conventional wisdom goes, not thinking about bonds. They are instead on beaches and thinking about piña coladas.

But deals still trickle through. Last year, there were €5.5bn and £750m of benchmarks sold during those quiet few weeks, a far cry from the roughly €41bn-equivalent sold in the five weeks before then, according to GlobalCapital’s Primary Market Monitor.

This year, there are some compelling arguments for borrowers to take better advantage of the summer primary market.

The first is that corporate bond investors are still cash-rich. Between January 2024 and the middle of last month, investment grade bond funds had only seen seven weeks of net outflows, the last of which came in April.

The effect of this on order books is plain. RTE attracted €7.4bn of bids for €1bn of debt this week, or consider Bromford Flagship’s £1.2bn book for its £300m deal.

There has also been a subtle shift in investor expectations. It has long been said that the reason issuers don’t come during the depths of summer is that investors do not expect them to, theoretically making it harder to draw a crowd.

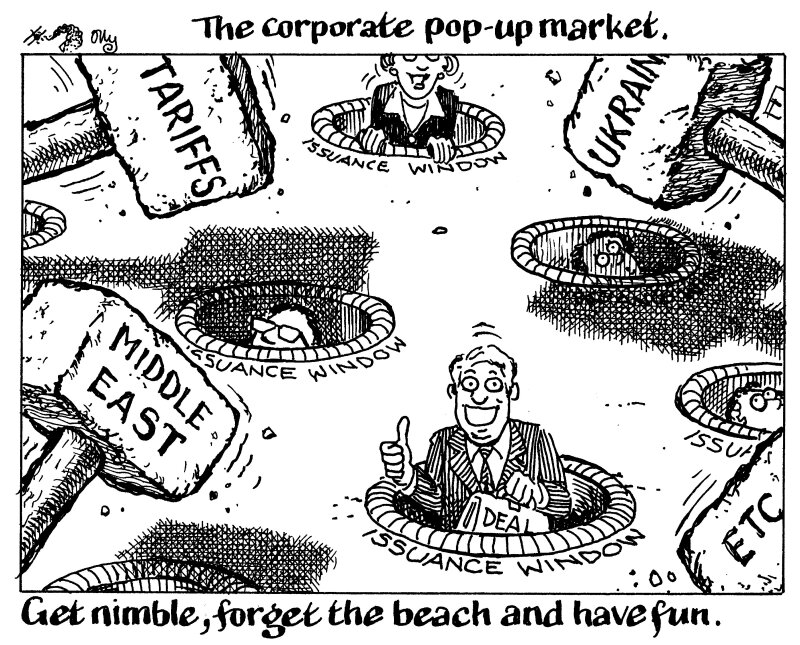

But borrowers have been shuffling issuance schedules around for much of the year to avoid volatility driven by US tariff policy, and to take advantage of windows between violent escalations in the Middle East and Ukraine.

Investors are used to a more nimble, less traditional approach to the market by borrowers.

All of this points to a supportive market for those borrowers shrewd enough to take advantage.