Euro

-

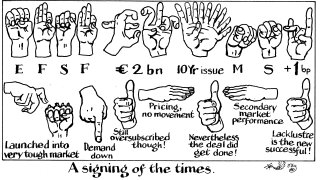

Issuers put weight on secondary performance as a marker of what makes a good deal as volatility rips through markets

-

Subordinated debt cushion spurs Moody's upgrade decision

-

Some question whether the ad hoc meeting will be enough

-

As tier two spreads widen, new issuers might find a saving in avoiding a call option

-

Amid widening in FIG bond spreads, bankers are navigating senior and subordinated deals into next week

-

Aareal and Wuestenrot offer single digit premiums for short, defensive deals

-

Issuer draws smallest demand in years despite Moody’s upgrade this week

-

Chinese owned car roof firm offers decent pricing on its loan comeback

-

Primary FIG issuance will need to adjust after sharp widening in bank bond spreads

-

No tightening until market stabilises with new issues to dry up

-

Some hoping for clues this week as to what funding EU is planning for next six months

-

Recent subordinated deals spotted up to 35bp wider in secondaries, pouring cold water on the prospect of further supply