Top Section/Ad

Top Section/Ad

Most recent

Mexico paid a similar new issue premium for its $9bn deal last week

◆ What has driven this week's record issuance and what might threaten sentiment ◆ Why the Maduro affair is a wake-up call for the EU ◆ Resolving Venezuela's debtberg

New issue premiums were slim for the LatAm sovereign duo

It will take years and huge amounts of money to get Venezuela in a state to restructure its debt

More articles/Ad

More articles/Ad

More articles

-

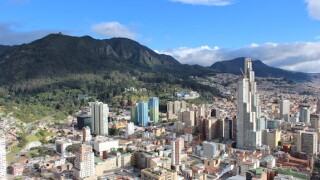

As Colombia works on the initial stages of developing a social bond framework, the sovereign has identified gender and immigration as two of its key pillars.

-

Chilean cable company VTR brought life to the Latin America primary bond market on Wednesday, but the company was unable to tighten its new senior-secured eight-year deal beyond guidance as markets are remaining functional but cautious in the face of rising US Treasury yields, said bankers.

-

Holders of more than 96% of Entre Rios bonds participated in a consent solicitation that will grant the issuer debt relief and see creditors abandon legal action, leaving just three Argentine provinces in default.

-

Covid-19 has made combining market-friendly economic policy with retaining popular support even trickier than usual for Latin America's politicians. In turn, it has become harder for bondholders to read the political tea leaves when weighing up where their money is best parked. For instance, investors who once loved Jair Bolsonaro's Brazil are now high-tailing it to other markets, including El Salvador, where another populist has just won power. In a busy year for LatAm elections, and with the pandemic still raging, allocating capital in the region's bond markets will be trickier than usual.

-

InRetail Peru Corp is looking to issue a $750m bond through its consumer division in an attempt to offer buyers greater liquidity and more diversified credit exposure than its previous bond issues, which have never exceeded $400m.

-

Colombia has increased its external funding programme for the year to over $10bn after forecasting a larger 2021 fiscal deficit than it recorded in 2020, exacerbating concerns about the government’s ability to maintain its investment grade credit rating.