EMEA

-

The parties failed to reach a deal to restructure Ethiopia's only Eurobond, despite a haircut offer

-

◆ Improved French market and political backdrop ◆ 'Healthy' NIP ◆ Plenty of French issuance

-

Issuer completes its final euro deal of 2025 and plans to hit the ground running in January across dollar, sterling and Swiss francs potentially

-

Improved market and political backdrop tempts insurers to push on with strategic debt capital financing

-

◆ Flow picking up in quiet sterling market ◆ CMA's redetermination unlikely to change credit metrics for UK water companies ◆ Logistics real estate issuer kicks off euro green bond

-

Macron's vision of a sovereign EU appeared closer in bond markets this week, thanks to French political discord

-

Several public sector borrowers brought well received deals this week

-

Record tight sub/senior spreads could lure US corporates to issue euro hybrids

-

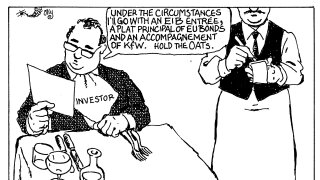

German government spending programme drives interest in capital raising for acquisitions

-

◆ Deal draws substantial order book ◆ LCR categorisation a pull for investors ◆ Sustainable label draws 'prestigious names'

-

◆ Sub-benchmark deal garners strong domestic bid ◆ Pick up offered to SSAs and larger deals ◆ Small concession needed to secure long end deal

-

The country has turned things around after falling into below investment grade territory