Deutsche Bank

-

Bank Julius Baer, the operating company of the private Swiss bank, took an unusual approach for its debut euro issue this week as it raised €500m of senior funding with the yield set at 0% from the outset.

-

Naturgy Energy, the Spanish gas and electricity utility, has doubled the size of its revolving credit facility in an amend and extend exercise, the latest demonstration that the balance of power in the loan market remains firmly on the side of the borrowers.

-

Tyre manufacturer Gajah Tunggal had to battle weak sentiment around Indonesian credits to sell a $175m bond this week.

-

eHi Car Services tapped its 2024 notes for an additional $150m on Wednesday, bringing the total deal size to $450m.

-

Europe’s high grade bond market hosted issuers at both ends of the rating spectrum on Wednesday, with Italian transmission company Terna and Singapore’s Ascendas Reit finding ample demand for their higher rated debt.

-

GlobalCapital reveals today the winners of its Bond Awards 2021, including celebration of the achievement of top corporate banks and issuers — and Lifetime Achievement Awards for two of Europe’s most prominent corporate funding officials.

-

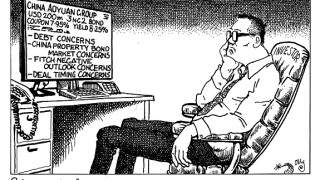

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

Snus tobacco and match producer Swedish Match has made a rare stop in the euro bond market to issue its first offshore deal of the year. Elsewhere, QNB Finance and First Abu Dhabi visited a pair of niche currencies.

-

There was little let-up in demand for property companies' bonds on Tuesday, as investors stocked up on Inmobilaria Colonial and debut issuer Sirius Real Estate, before the void of issuance expected from the tail end of this week.

-

Stellantis, the entity formed by the merger of car makers Fiat-Chrysler Automobiles and PSA Group, printed what the lead managers reckon was the longest maturity bond in euros from the sector in its ratings bracket, though the market was divided over whether peers could print similar deals.

-

Bank Julius Baer, the operating company of the private Swiss bank, is set to dip its toes into the euro bond market for the first time.

-

Deutsche Bank has hired two former Barclays bankers to support its China business.