Currencies

-

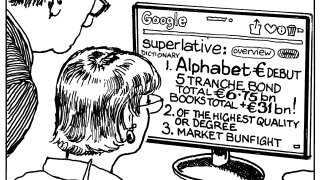

◆ UK issuer makes swift euro return ◆ NIP much lower than US banks paid ◆ Big subscription reflects investor uncertainty

-

◆ $9bn raised in one go, peers inspired ◆ ‘Very efficient’ dual-tranche serves issuer well ◆ Tight Treasury spread but 'where the market trades’ is important

-

◆ Less frequent and smaller Europeans return after Iccrea reopening ◆ Latest sub-benchmark Austrian deal adds issuer diversity ◆ CCF meets annual funding need

-

Lenders in Nordics say there is pressure to sign deals before 90 day US tariff reprieve ends

-

Issuer was originally looking at a $1bn trade but found healthy demand

-

Fiserv and Visa print across the curve with more tipped to come

-

◆ Swap spread stability enables large $5bn trade ◆ Spread to US Treasuries gets squeezy ◆ Alternative executions considered but not needed

-

◆ Similar trades clash on the same day ◆ New Zealand bank finds it more challenging to attract orders despite paying higher spread and new issue premium ◆ Swedbank lands deal with similar concession than recent French senior paper

-

◆ 'Helpful messaging' matters ◆ Attrition rate higher than recent tier twos ◆ Some saw negative concession

-

◆ NIB, IADB, CEB price bonds ◆ Busy week drains liquidity from market ◆ Treasury spreads at 'historic' tights

-

The company has refinanced and increased its loan by another €100m

-

◆ ‘Decent book’ 5.3 times covers deal ◆ Third govvie to bring a deal in two days ◆ Valuation still tight versus most peers