Top Section/Ad

Top Section/Ad

Most recent

Record fundraising in 2025 has left private lenders fighting for deals

Long seen as adversaries, banks and private credit lenders are getting used to working together

Fahy will also lead asset-based finance origination

Direct lending default rates tick higher amid notable distressed situations

More articles/Ad

More articles/Ad

More articles

-

Europe’s Capital Markets Union project was supposed to place a regulatory rocket underneath the region’s private debt markets. But it has been slow work so far. What are the next steps for official support of the asset class? Owen Sanderson reports.

-

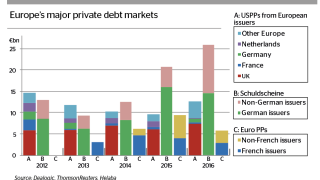

The widely admired US private placement market has inspired the development and growth of private debt markets in Europe. But hopes of replicating in Europe the US model, governed by regulation and convention, of a single market with one set of documents, have been pushed back. As Jon Hay reports, the market now looks headed towards a more varied ecosystem.

-

Volkswagen is planning a return to public bond markets for the first time since it was engulfed by its emissions test cheating scandal in September 2015, write Michael Turner, Silas Brown and Jon Hay.

-

The Schuldschein market has stumped up €900m for Volkswagen in its first syndicated, unsecured debt issue in its own name since it was engulfed by its emissions test cheating scandal in September 2015.

-

Volkswagen’s main borrowing entities have not issued unsecured bonds since the company became embroiled in its diesel emissions test cheating scandal in September 2015. Last week, however, the company took a first step back, with a €900m Schuldschein issue for its financial services arm.

-

The Financial Conduct Authority is reviewing aspects of the UK’s primary markets regime, with a particular focus on whether the UK needs a specialised wholesale debt listing venue, like Ireland’s GEM market.