Top Section/Ad

Top Section/Ad

Most recent

Embattled utility makes final plea for court to sanction £3bn in emergency funding

Thames Water refinancing battle is an unedifying mess

Embattled utility asks judge to approve £3bn lifeline as creditor groups keep fighting

High yield issuers may be worried about market access, but some do not see them losing it

More articles/Ad

More articles/Ad

More articles

-

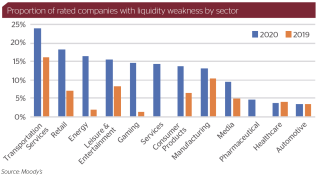

Fresh fears are rising about the future of companies already pummelled by the economic ramifications of the coronavirus pandemic. New research suggests that the worst affected industries will be the hardest hit again as Europe heads into another round of major lockdowns.

-

Indonesian high yield companies that had limited access to the international bond market this year due to the Covid-19 pandemic are now preparing for a challenging 2021 — unless sentiment gets a dramatic boost from the vaccine news. Morgan Davis reports.

-

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

Corporate finance in 2020 was utterly without precedent. Never before had so many once-stable firms seen revenues evaporate instantly, with so little visibility on when the world might recover. Companies did whatever they could to hang on, pulling every lever available to source scarce cash. As 2021 begins, so will a new phase, where the fallout of the Covid rescue playbook becomes clear. Owen Sanderson reports.

-

This year proved to be one of the most dramatic on record for corporate financiers as volumes rose from the ashes of the market sell-off. David Rothnie examines some of the themes that defined the year and looks ahead to 2021.

-

Hot capital markets emphatically supported Casino's opportunistic refinancing this week, a deal that catapulted the troubled supermarket group back into the leveraged credit mainstream. Traditional investors and specialist hedge funds combined to allow lead banks to price the dual tranche deal through the undisturbed levels of Casino’s outstanding debt. Owen Sanderson reports.