Top Section/Ad

Top Section/Ad

Most recent

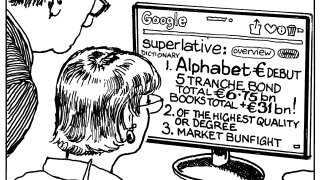

The US tech giant kickstarted what could be a deluge of debt issuance from the largest US tech firms

◆ Junior note lands tight to Class As ◆ No concession needed ◆ Lack of sterling supply allows for tight pricing

◆ Peak book the largest for an IG corporate in sterling since early November ◆ Issuer takes size at a tight spread ◆ Wide range of fair values spotted

◆ Spanish entity hits market with tight, opportunistic trade ◆ Some attrition as deal priced through inflection point ◆ Trade lands through fair value

More articles/Ad

More articles/Ad

More articles

-

◆ Storied real estate company opens books after ratings downgrade ◆ New issue concession in the low single digits ◆ Investors keen to buy cyclical names

-

Google owner returns to dollar market for first time since 2020 for joint tightest 30 year spread ever

-

Fiserv and Visa print across the curve with more tipped to come

-

◆ Books bulge for three year deal ◆ Sizes and new issue concessions reflect demand differences ◆ Trade comes amid major data dumps

-

◆ European and US growth figures released during bookbuilding ◆ Demand proves decent for EDF ◆ Worries bubble up that market is not pricing in risk properly

-

◆ Debut deal from Google owner ◆ Combined peak demand hits €31.5bn ◆ Curve steepens by 3bp during book building