Central and Eastern Europe (CEE)

-

Pepco, the retail conglomerate that owns Poundland, is seeking to list in Warsaw through an initial public offering.

-

Ukraine entered the bond market on Monday seeking dollar funding at a time when it faces a number of problems from heightened military tensions with Russia to uncertainty over its relationship with the IMF.

-

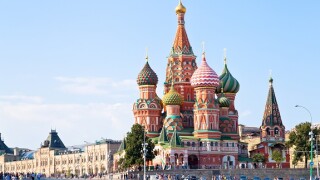

Russian paper and pulp company Segezha is covered across its initial price range in its IPO, showing that Russian companies can withstand political volatility when doing an IPO.

-

-

Emerging markets bond buyers and issuers are regaining confidence as US Treasury volatility falls, with issuance in CEEMEA and Latin America having picked up in recent days and a pipeline building.

-

A campaign by a political opposition party questioning the deployment of Turkey’s FX reserves and a snub from the United States has put new pressure on the country’s bonds.

-

Segezha, the Russian paper and pulp company, has set a price range on its IPO despite the growing pressure faced by Russian companies as hostility between the country and the US increases.

-

Russian steelmaker Metalloinvest has secured a $350m credit line from international lenders. Metalloinvest is the second Russian corporate to tap international lenders since fresh sanctions were announced against Russia by the United States.

-

Etalon, the Russian real estate and construction company listed in London, has launched a rights issue to help fund its investment in new land and development.

-

Sovcomflot, the majority state-owned Russian shipping company, defied some market participants' expectations on Tuesday by coming to market to raise dollar debt just days after a fresh wave of US sanctions on Russia.

-

Pegasus Airlines was seeking on Monday to issue a Eurobond in dollars. The deal will demonstrate market appetite for Turkish credit after the country navigated another economically tumultuous month, which saw investor confidence drop.

-

Slovakian lender Tatra Bank concluded several days of marketing with the sale of its debut green bond on Friday, raising €300m of preferred senior paper, which it will count towards minimum requirement for own funds and eligible liabilities (MREL).