Central and Eastern Europe (CEE)

-

Republika Srpska, an autonomous entity in Bosnia and Herzegovina, was set to issue a five year Eurobond at 4.75% on Friday, but those on the deal were not certain of reaching the maximum €200m size.

-

Poland’s domestic bond market is not as big as participants would like it to be. It needs standardised documentation, they say, along with more ratings and the adoption of transparent, fixed rate coupons. Philip Moore reports.

-

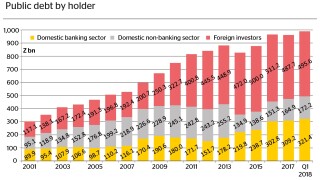

Polish GDP impressed in the first quarter of 2018, growing 5.2% year-on-year, up from the 5.1% estimated, driven by higher consumption and investment in infrastructure co-financed by EU funds. Ukrainian migrants have also boosted GDP. But with proposed cuts to EU funding set to hit Poland hardest — at a cost of 1% of GDP a year from 2021, according to some estimates — the outlook is not so rosy. Virginia Furness reports.

-

The Republic of Poland has proved itself to be one of the most prudent and innovative borrowers in central and eastern Europe, leaving it well placed to navigate increasing volatility in global rates, while some less prepared issuers may run into funding difficulties. Virginia Furness reports.

-

When Standard & Poor’s revised its outlook on Poland to positive in April, it was the latest in a series of welcome surprises. The economy has grown faster than most analysts expected, leading several of them to upgrade their forecasts for growth in 2018. In the capital market, meanwhile, it was Poland, rather than any of the core eurozone economies, that became the first sovereign in the green bond market. What next for Poland’s vibrant economy and capital market? Participants answering this question in the GlobalCapital Poland roundtable, which took place in London in early June, were:

-

The Republika Srpska region of Bosnia and Herzegovina is seeking to issue a five year bearer bond of up to €200m through Hong Kong-based broker BMI Securities, but investors are cautious that this is not a run of the mill CEE bond issue.

-

-

-

Turkey’s Sasa Polyester is on track to take out a €231m export credit agency-backed loan to build a new facility in its home country.

-

EPP, a Polish real estate investment company, postponed its five year euro bond on Monday despite having gone as far as to set the yield for the deal. The company blamed adverse market conditions, while bankers away from the deal were divided as to whether anything could or should have been done differently by the leads.

-

Despite worries that Russian investors are pulling away from London as the UK looks to pressure allies of the country's president Vladimir Putin, Tom Tugendhat, the chairman of the House of Commons Foreign Affairs Committee, this week told GlobalCapital that preserving the rule of law in the UK and making sure markets are “clean and honest” is more important than attracting Russian capital to London.