Cartoon

-

If a company’s bonds were yielding more than 40% last December, what would have been the chances it would be in a position to raise market funding this week? That’s exactly what UK poultry producer Boparan has achieved in an extraordinary reversal of fortunes against the backdrop of a global pandemic.

-

It felt like a great weight had been lifted from financial markets this week. Two weights in fact.

-

Just because it seems unlikely that in the US election the Democrats will take both the White House and the Senate, it does not mean that capital markets should become despondent about a fiscal stimulus package that could have reached $2.3tr had the so-called "blue wave" made a clean sweep.

-

The Shanghai Stock Exchange stunned the market on Tuesday by halting Ant Group’s $34bn IPO, set to be the largest listing in history, just two days before the company’s planned stock market debut. The extraordinary move is expected to delay the listing by at least six months. It will also force investors to revalue the company, write Jonathan Breen and Addison Gong.

-

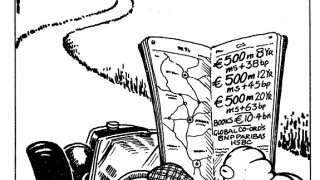

German dairy group Müller has sold €250m of US private placements across five, seven and 10 years maturities.

-

Capital markets players have a variety of stances on the forthcoming US presidential election. A survey by UBS this week found 51% of wealthy US investors wanted Joe Biden to win, while 55% of business owners favoured Donald Trump.

-

Chinese financial technology company Ant Group has sealed the world’s largest ever IPO, raising $34.4bn from dual listings in Shanghai and Hong Kong. The company built two mammoth order books despite a turbulent week for equity markets globally — although that created serious challenges for bankers allocating the stock. Jonathan Breen reports.

-

Compagnie Générale des Etablissements Michelin, the French tyre company, won more than €10bn of demand for its €1.5bn bond issue on Monday. Now a growing number of corporate bankers expect to see European high grade spreads return to pre-Covid 19 levels.

-

Prudential rules will become more supportive for UK banks after Brexit.

-

After months of waiting as even the great whites of the SSA oceans kept clear of primary bond sales in anticipation, the EU — now a bond market megalodon by comparison — cruised into a bait ball a quarter of a trillion euros big this week to take a €17bn bite out of its enormous pandemic recovery borrowing programme. Lewis McLellan and Bill Thornhill report.

-

Agricultural Development Bank of China returned to the offshore renminbi market this week with a Rmb5.7bn ($854m) triple-tranche transaction. The deal featured a rare 10 year tenor in the dim sum market, showing the potential for more long-dated CNH funding. Addison Gong reports.

-

Equity markets are pricing in a big win for Democrats in the US elections in November, meaning a large post-election stimulus package to help the economy through Covid-19. However, they should be wary as president Donald Trump is far from beaten.