Cartoon

-

Limited partners in private credit take a hands-off approach when investing in direct lending funds. But they need to pay attention.

-

India’s first listing of a unicorn has started, as Zomato, a food delivery start-up, made its second day of bookbuilding on Thursday for a Rp98.9bn ($1.32bn) IPO. Droves of investors have already oversubscribed the deal, paving the way for the pipeline of technology listings to come, writes Jonathan Breen.

-

Uzbekistan re-entered the international bond markets on Monday for its third ever issue. The dual currency bond it was marketing aimed at drawing in the widest possible investor base, market participants said

-

American Honda, the North American subsidiary of the Japanese automotive maker, hit screens with a euro benchmark trade on Tuesday, as corporate bankers reckon central bank tinkering will see a rise in Reverse Yankees at the back end of the year.

-

Banks that have access to diverse pockets of demand will be far better equipped to deal with any contraction in central bank liquidity, which could occur if high inflation spooks policy makers and markets.

-

SoftBank returned to euro and dollar bond markets after a three year absence to issue an eight tranche deal, raising more than $7bn-equivalent from total demand of more than $16bn, and hitting every empty spot in its funding curve at once.

-

Spain raised €8bn this week with its fourth syndication of the year, demonstrating that in spite of the Next Generation EU’s €20bn debut last week, the euro market still has plenty of depth. Concerns about hedge funds placing enormous orders are starting to recede, said bankers on the deal.

-

Chinese technology companies are flocking back to the US for IPOs after months of poor market conditions and the regulatory crackdown on the sector brought deal flow to a near halt. There is more on the way too, as issuers look to wrap up deals before the summer slowdown. Jonathan Breen reports.

-

The European Union stunned onlookers this week with its first deal under its Next Generation EU programme, raising a record-shattering €20bn in a single tranche. Lewis McLellan reports.

-

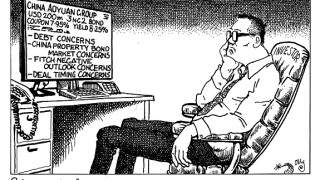

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

A brace of sukuk trades from the Gulf this week racked up enormous order books, demonstrating the voracious demand for Sharia-compliant paper. With a hungry investor base, sukuk issuance is expected to grow, despite some "teething problems".

-

Investors had plenty of appetite for a super-high yielding additional tier one from Piraeus Bank this week. Will they still be hungry when Greek banks try and issue large volumes of senior debt for their regulatory requirements?