Cartoon

-

Supra pulls in €103bn of demand to set up ideal backdrop for peers

-

Sustainable finance finally hit the leveraged finance markets this year. The concept is headed for a rollercoaster ride

-

China’s Panda bond market is at full throttle this week with four issuers out with deals

-

Until the European Central Bank starts to pull back from providing such cheap repo lending, issuers have little incentive to diversify their funding

-

The double-A rated Singaporean issuer seals $800m deal at a record low spread on a busy day for the bond market globally

-

Spain will come to market on Tuesday for its first ever green bond

-

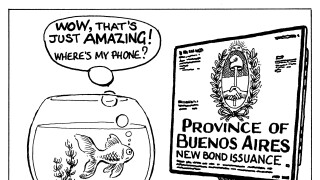

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories

-

20 years the sweet spot for US corporate issuers in euros

-

Investors are hungrier than ever for the asset class as markets move on from the coronavirus crisis

-

A flurry of event-driven financing is in the works in Asia, and will test the market’s appetite for higher leverage ratios

-

Borrowers still have a golden opportunity to get funding away before the Fed’s conference next week

-

Covered bonds exploded into life this week with a pair of five year Pfandbriefe. But participants are wary that rates volatility may unhinge the bank finance market