Cartoon

-

Many in market say Europe has moved past poll worries, but issuer actions suggest otherwise

-

Compelling relative value, larger sizes and greater outcome diversification hold key to developing market

-

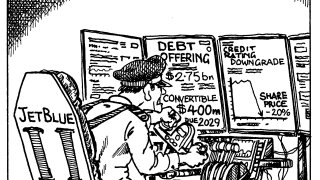

US airline issues convertible first thing Monday morning after last week’s volatility, then sees shares nosedive

-

Lower rates will give the market a boost even as other sectors curdle at the prospect of a recession

-

Australian state prices through domestic curve, despite lower-than-expected investor demand

-

Gas company more than triples size of debut as a surge of first-time issuers highlight market revival

-

Bigger, more frequent issuance predicted to follow CEE issuer's inaugural deal

-

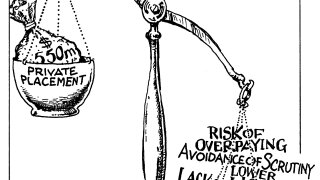

Investors dislike the lower transparency and liquidity inherent in private placements

-

French investors return to the primary market after Bastille Day, as the market signals benign conditions

-

Issuance volumes dwarf any previous year-to-date figure on record

-

Only companies with their backs against the wall will accept paying so much more spread than peers with similar ratings

-

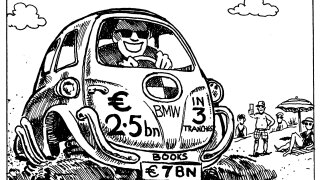

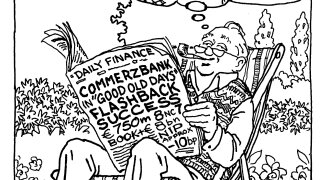

◆ Leads say deal landed well inside fair value ◆ Rivals say result points to ‘halcyon days’ of early 2024 ◆ Other issuers said to be eyeing Rabobank's callable FRN structure