Cartoon

-

The next six months of 2024 are shaping up to be more like a three week window

-

‘Still some work to be done’ in bond market’s digital transition

-

◆ More than €12bn of interest for popular offering ◆ 'All box-ticking' social leg was expected to do well from the start ◆ 11 year non-call 10 tranche shows duration demand intact

-

Presidents and premiers are said to obsess about legacies. Nearly two years after leaving office, Liz Truss may be about to secure hers

-

Higher rated DSM also has smooth ride, as corporate market continues to pump out solid trades

-

Second half of 2024 is tipped to be a shadow of its busy first six months

-

Many FIG issuers were quick to abandon the primary market this week, but it could get a lot worse

-

Where other markets fumbled, IG corporate bonds added more than €10bn of debt to the year’s total

-

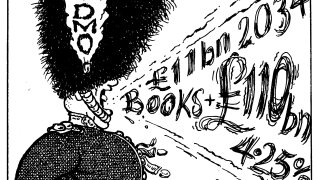

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors

-

Sure, covered bond new issue premiums are back while order books are smaller — but good times are still to come

-

Pharmaceutical giant ends nine year absence and takes Sfr2.2bn from its home market

-

Domestic investors dominate despite European interest but Asia buyers take less than in previous deals